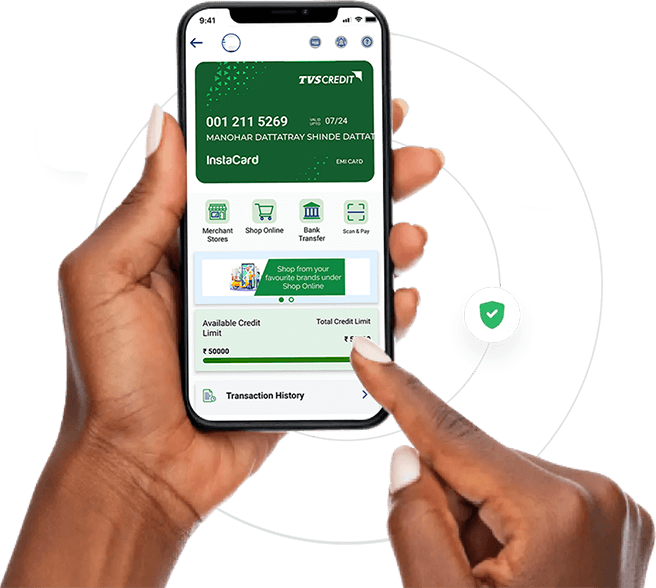

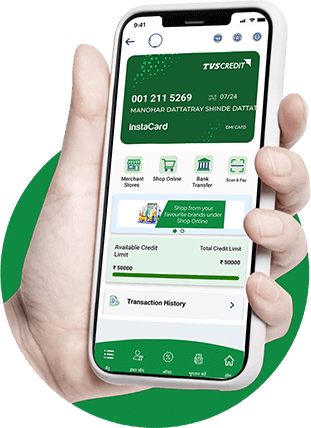

InstaCard is the pre-approved credit limit facility provided by TVS Credit to avail instant loans up to Rs. 1 Lakh*

Shop at your nearest merchant store with easy EMI Payment option. Accepted at over 25,000 merchant stores.

Know More

Purchase at your convenience from any of our online merchant stores without any hassle

Know More

Simple 2 click option for all your instant cash needs by transferring up to Rs. 25,000 to your registered bank account in just 30 minutes.

Know More

Download TVS Credit Saathi App

Activate your InstaCard

Use your InstaCard

Use this credit limit at stores which cover categories such as lifestyle, home improvement, education, health, travel, furniture, appliances, etc.

Plan your EMIs according to your convenience. Divide your purchase into easy EMIs of 3, 6, 9, 12, 18 or 24 months.

Request for a loan via TVS Credit Saathi App or our merchants stores and get instant loan disbursal, without any hassle of documentation.

Visit any merchant outlet that is empanelled with TVS Credit and share your mobile number to avail Zero Cost EMI*.

Enjoy zero processing fee on shop online purchases*

| Schedule of Charges | Charges (inclusive of GST) |

|---|---|

| Processing Fees | Upto 10% |

| Penal Charges | 36% per annum on unpaid installment |

| Foreclosure Charges | Nil | Other Charges |

| Bounce Charges | Rs.500 |

| Duplicate NDC/NOC Charges | Rs.250 |

For a complete list of charges, please click here

Disclaimer : These results are for indicative purposes only. Actual results may vary. For exact details, please contact us.

You can activate the pre-approved credit limit loan facility through the TVS Credit Saathi app. The steps are as follows:

InstaCard can be used for shopping, purchasing, and payment needs across online and offline merchant networks, covering categories such as electronics, consumer durables, lifestyle, home appliances, furniture, education, health, travel, domestic usage, etc.

All transactions are converted into a loan on the basis of the loan request submitted through TVS Credit Saathi App or merchant stores. Monthly interest rate up to 3%* is applicable. Please, refer to the grid below to understand the repayment tenure options.

| Amount ( ₹ ) | 3 Months | 6 Months | 9 Months | 12 Months | 15 Months | 18 Months | 24 Months |

|---|---|---|---|---|---|---|---|

| 3000 to 5,000 | |||||||

| 5,001 to 10,000 | |||||||

| 10,001 to 20,000 | |||||||

| 20,001 to 30,000 | |||||||

| 30,001 to 40,000 | |||||||

| 40,001 to 50,000 |

You can avail a maximum of 3 parallel loans within the approved limit using your InstaCard subject to terms and conditions communicated from time to time.

You can do a minimum transaction of Rs.3000 and a maximum transaction of Rs.50,000 in a single transaction.

Your monthly EMI for your InstaCard instant loans will be debited from the same bank account registered with us for your previous loan.

Yes, on your InstaCard, you will be charged interest from the date of loan disbursement for successful transactions.

Steps to use the InstaCard Bank Transfer option:

Steps to use the InstaCard Merchant store option:

Steps to use the InstaCard Shop Online option:

You can access a Virtual EMI card in the TVS Credit Saathi App which is just a unique identification number. But If you require a physical InstaCard you can place a request by paying Rs.100.

If you have any queries or need assistance regarding availing the loan facility on my InstaCard, you can reach out to us at 044-66-123456 or via email at helpdesk@tvscredit.com.

Terms & Conditions for InstaCard

In connection with the loan availed by the borrower (“Borrower”) under the loan agreement (“Master Loan Agreement”), the Borrower has opted to enroll in the Pre-approved loan programme (defined below) offered by TVS Credit Services Limited (“TVS Credit / Company”), wherein the Borrower sanctioned with a pre-approved credit limit , Subject to fulfilling the eligibility criteria, the customer shall be entitled to use the credit facility by transferring the funds to the bank account or for purchases at TVS Credit empaneled merchant establishments and e commerce platforms.

The terms and conditions (“Terms and Conditions”) mentioned herein are applicable to the enrolment to the pre-approved loan programme by the Borrower. These Terms and Conditions read with the terms of the Master Loan Agreement constitute the entire agreement between TVS Credit and the Borrower, as amended from time to time.

By completing the sign-up process for enrolment under the pre-approved loan programme, the Borrower is deemed to have expressly read, understood, accepted and be bound by the Terms and Conditions set out herein. TVS Credit reserves the right to change, at any time, these terms and conditions, features and benefits offered under the pre-approved loan programme including, without limitation to, changes which affect existing balances, methods of calculation. The eligible Borrower agrees that he shall be liable for all charges incurred and all other obligations under the revised terms.

1.1. In this document, the following word and phrases shall have the following meanings:

(a)“Pre-approved loan programme” shall mean the program offered by the Company and consented to by the Borrower, by paying the necessary fee, wherein the Borrower may be enrolled as a member subject to meeting the eligibility criteria.

(b)“InstaCard/Card” shall mean a Physical or Virtual Card (carrying the unique identification number) issued to the Borrower in terms hereof. THIS IS NOT A CREDIT CARD, OR A DEBIT CARD OR A PREPAID CARD etc. and It is issued by TVS Credit to the Borrower for easy identification and usage of the Pre-approved limit with the TVS Credit partnered merchant (offline & online) networks, whether or not such Borrower has previously availed any loan facility from TVS Credit.

(c)“Fees/Charges” means such charges as set out in these terms and conditions. All details mentioned herein shall be provided in the loan term sheet unless specifically communicated to the Borrower and as amended from time to time.

(d)“EMI/Equated Monthly Instalments” shall mean the amount payable every month by the Borrower to TVS Credit comprising of principal amount, interest and other charges, as the case maybe.

(e)“Pre-approved loan – Application Form” shall mean and include the application agreed, executed/ to be executed by the Borrower in the form and manner stipulated by the TVS Credit, from time to time.

(f)“Welcome letter” means a letter sent by TVS Credit to the Borrower setting out the pre-approved loan programme/ credit details and the gist of important terms and conditions applicable for availing/utilizing the Credit facility.

(g)“Merchant Establishment” shall mean the Merchant network created by TVS Credit with the establishments, wherever located, which honor the pre-approved loan programme facility, may include among others, stores, shops, hotels, airlines and mail order advertisers.

(h)“POS” / “EDC” means Point of Sale / Electronic Data Capturing machines used at Merchant Establishments in India, capable of processing transactions and at which, the Borrower can use his given credit limit sanctioned to him Instantly.

2.1. Eligibility Criteria:

2.1.1. In order to be eligible to use the benefits of the pre-approved loan programme, the Borrower must have repaid at least 3 EMIs or as stipulated without default.

2.1.2. Notwithstanding the above, the entitlement to use the facility by the Borrower in the Pre-approved loan programme shall be at the sole discretion of the Company.

2.1.3. The Borrower may opt for the pre-approved loan programme by submitting the pre-approved loan – Loan Application Form with TVS Credit. TVS Credit, based on the aforesaid criteria, may accept or reject the pre-approved loan – Loan Application Form. In the event of any suspension/ withdrawal of the credit facility due to any kind of improper repayment behavior, the Borrower agrees that TVS Credit shall not be obligated to refund any fee / enrolment fees paid by the Borrower.

2.2. Enrolment:

2.2.1. TVS Credit will send a Welcome Letter setting out the pre-approved loan programme/ credit details and the gist of important terms and conditions applicable for usage of the credit facility through the given contact modes/details

2.2.2. Upon receipt of the Welcome Letter, the Borrower can activate the pre-approved loan programme facility through TVS Credit Saathi app (“Saathi App”) (or) through TVS Credit’s website accessible at (“TVS Credit Website”) (or) by raising a request in TVS Credit’s customer care contact number.

2.2.3. Once the Borrower receives an SMS / e-mail trigger from TVS Credit confirming successful enrolment to the pre-approved loan programme and sanctioning of a Credit Limit to his/her registered mobile number / e-mail id, as the case maybe, the Borrower shall login to the Saathi App/ TVS Credit Website / IVR using registered mobile number and activate the Pre-approved loan programme facility to get his Pre-approved loan entering his date of birth & OTP sent to his registered mobile number.

2.2.4. Post successfully providing the credentials, the Borrower will receive Preapproved loan programme facility activation confirmation via SMS /e-mail to his registered mobile number / e-mail id, as the case maybe.

3.1. The Borrower agrees that any facility / transaction under this Preapproved loan programme shall be considered as a separate loan facility and the terms and conditions of the Master Loan Agreement executed/ to be executed by the Borrower will be binding and applicable.

3.2. The eligibility of credit limit, benefits, offers / other additional services offered under the pre-approved loan programme shall be at the sole discretion of TVS Credit.

3.3. The Borrower shall place the request every time to utilize the Credit facility from TVS Credit (which shall be subject to the terms of the Master Loan Agreement), before making any transactions under the pre-approved loan programme.

3.4. The membership to the pre-approved loan programme shall be non-transferable and non-assignable. The credit facility shall be valid for use only in India and for the purchase of goods or services in Indian currency only. Also, there shall be restrictions in the usage at certain merchant locations / establishments/ category either permanently or as may be communicated from time to time.

3.5. The Borrower always undertakes to act in good faith in relation to all dealings with the pre-approved loan programme and TVS Credit.

3.6. The Borrower agrees that the loan facility under the pre-approved loan programme is not intended to be used for purchase of prohibited items under the applicable laws of India like lottery tickets, banned or proscribed magazines, participation in sweepstakes, payment for call-back services, etc., or transactions dominated in foreign currency.

3.7. TVS Credit shall not be responsible for any failures or errors or malfunctioning of POS or system or terminal during operations or electronic data capture.

3.8. In the event of any breach of these terms and conditions by the Borrower, he/she shall be liable for any loss, directly or indirectly, resulting from such a breach; and liable to pay TVS Credit, upon demand. The default if any committed by the Borrower in respect of his/her credit facilities availed from TVS Credit will also constitute breach.

3.9. In the event of any disagreement or dispute between TVS Credit and the Borrower regarding the materiality of any matter including any event, occurrence, circumstance, change, fact, information, document, authorization, proceeding, act, omission, claims, breach, default or otherwise including use or misuse of the Pre-approved loan programme facility, the opinion of TVS Credit as to the materiality of any of the foregoing shall be final and binding on the Borrower. The Borrower shall be bound by these Terms & Conditions and policies stipulated by TVS Credit, from time to time, in this regard.

3.10. For details of Charges, refer the loan term sheet which will be provided by TVS Credit for each usage of Credit limit /transaction made by the Borrower. These charges are subject to changes at the sole discretion of TVS Credit. However, such changes in charges may be made only with prospective effect giving prior notice of thirty (30) days to the Borrower.

3.11. Any kind of misappropriation of the facility availed, under such circumstances, TVS Credit will take any kind of legal action as per Law.

3.12. The borrower agrees and accepts that there will not be any NOC for the primary loan agreement if there is a default in the credit facility repayment

3.13. The borrower agrees and authorizes TVS Credit to exchange, share, disclose or part with all the information and details relating to the Borrower(s) CKYCR, KYC documents, existing loans and/or repayment history to any business entity with whom the TVS Credit has or may have any business tie-up and for the purpose of extending the additional features/value added services offered via TVS Credit in tie-up with the other business entity and accepted by the borrower.

4.1. The pre-approved loan programme shall be auto renewed every year by auto debiting the annual fee from the registered bank account of the customer. The fee, so charged shall not be refundable.

4.2. This annual fee shall be debited only for those customers who have not availed any loan under the pre-approved loan programme during the annual validity period.

4.3. The customer can also opt the value-added services/features by paying the additional charges applicable.

4.4. The customer has the option to cancel the renewal by submitting a written request to the customer support team. Upon cancellation the customer will no longer be entitled to the use any of the facility under this pre-approved loan programme. Such Cancellations shall not entitle the customer for claiming the refund on the annual fee charged prior to the submission of such cancellation request.

| Variant | Standard* | Premium** |

|---|---|---|

| Enrolment Fee (One time) | Rs.499 /- | Rs.699 /- |

| Annual Fee | Rs.117 /- (Inclusive applicable taxes) Pre-approved loan facility under this programme shall be auto renewed on the validity expiry month, which is mentioned on the face of the card.For Example: If the validity expiry month on the face of the card is 12/2022, then renewal fee will be debited in the month of December 2022. |

|

| Instant Bank Transfer Annual Fee | Rs.249 /- (Inclusive applicable taxes) Instant Bank Transfer annual fee shall be debited at the time of first usage within the pre-approved loan programme validity periodFor Example: If the pre-approved loan programme annual validity period is between 01/2022 to 12/2022 and the first usage is anytime during this period, Instant Bank Transfer annual fee shall be debited from the loan disbursal. |

|

| Annualized Rate of Interest % (p.a) for the loans booked under pre-approved loan programme | Customer will be charged effective Internal Rate of Return (IRR) ranging between 24% -35% on an annualized basis, as per Interest Rate Policy. | |

| Physical Card | Rs.100/- Customer shall make specific request via TVS Credit Saathi app post logging into the InstaCard homepage. Physical card shall be directly dispatched to the customer registered address only. |

|

*Standard variant of InstaCard programme shall allow the customer to use the pre-approved loan facility only with in the TVS Credit empaneled offline merchant network and the Instant Bank Transfer facility

**Premium variant of InstaCard programme shall allow the customer to use the pre-approved loan facility with in the TVS Credit empaneled offline & online merchant network along with the Instant Bank Transfer facility

5.1. Without prejudice to the foregoing, TVS Credit shall be under no liability, whatsoever, to the Borrower, in respect of any loss or damage arising, directly or indirectly, out of:

5.1.1. Any defect in any goods or services supplied, including delay in delivery or non-delivery, deficiency in services between the Merchant Establishment and Borrower and / or any third party.

5.1.2. Any misstatement, misrepresentation, error or omission in any details disclosed to TVS Credit. In the event of a demand or a claim for settlement of outstanding dues from the Borrower is made, either by TVS Credit or any person acting on behalf of TVS Credit, the Borrower agrees and acknowledges that such demand or claim shall not amount to be an act of defamation or an act prejudicial to or reflecting upon the character of the Borrower, in any manner.

5.1.3. The Borrower expressly accepts that if he / she fails to pay monies on due date, or which may be declared due prior to the date when it would otherwise have become due, or commits any default under the present terms, under which the Borrower is enjoying financial / corporate / other facility, then, TVS Credit shall, at its sole discretion, without prejudice, exercise all or any of its rights as set out in these terms and conditions. Any notice concerning payments given by TVS Credit hereunder will be deemed to have been received by the Borrower within seven (7) days of mailing to the Borrower’s mailing address last notified in writing to TVS Credit. Any notice may also be sent by fax or communicated verbally and confirmed in writing by post or fax. TVS Credit shall not be held accountable for delays in receipt of notices.

5.1.3.Any misappropriation/misuse of funds out of this facility, TVS credit shall not be held liable.

6.1. The customer grievances shall be addressed as specified in the Master Loan Agreement executed by the Borrower.

6.2. Any disputes with respect to pre-approved loan programme facility shall be raised by the Borrowers with the Customer Care Center within seven (7) days from such occurrence. Any dispute raised by the Borrowers after seven (7) days from such occurrence shall not be entertained by TVS Credit and the TVS Credit shall not be liable for the same in any manner whatsoever.

6.3. Any customer grievance with respect to OTP based authentication shall be conclusive evidence of the liability incurred by the Borrower. Any Charge Slip, or other payment requisition, received by Bank/ Partners for payment shall be conclusive proof that the Charge recorded on such a Charge Slip or other requisition, was properly incurred by the Borrower, unless the credentials were fraudulently misused, then the burden of proof shall lie on the Borrower. The other payment requisition referred to in this Clause shall include any and all payments pertaining to permissible expenses incurred by a Borrower at a Merchant Establishment by use of the credit facility which is not recorded as a Charge.

6.4. All disputes in relation to this, are subject to the exclusive jurisdiction of the competent Courts in Chennai only and the laws applicable shall be Indian laws.

7.1. The Borrower acknowledges and consents that the information under the pre-approved loan programme may be exchanged amongst other banks and financial entities that provide corporate facilities. The acceptance of an application for the pre-approved loan programme is based on no adverse reports of the individual’s creditworthiness.

7.2. TVS Credit may report to other banks or financial entities of any delinquencies in usage of the pre-approved loan programme loan facility. Based on the receipt of adverse reports (relating to the credit-worthiness of the Borrower or his/her family members), TVS Credit may, after 15 days’ prior notice in writing, cancel the Pre-approved loan programme facility, where upon the entire outstanding balance on the Pre-approved loan loans as well as any further Charges incurred upon usage of the Pre-approved loan programme facility, though not yet booked as loan to the Borrower, shall be immediately payable by the Borrower. The Borrower shall in no event dispute regarding the aforesaid terms.

7.3. TVS Credit will not send any monthly statement pertaining to any transactions made by the Borrower(s) under the pre-approved loan programme. The Borrower also confirms that all the details given in the pre-approved loan – Loan Application Form shall be true, correct and accurate and if there are any changes in the given details, he/ she will inform TVS Credit within a reasonable time period. TVS Credit disclaims all liability in case of incorrect details resulting in any loss or liability for the Borrower.

8.1. TVS Credit in its sole discretion may terminate the enrolment of the Borrower from the Pre-approved loan programme:

8.1.1. In the event the Borrower is declared insolvent or upon the death of the Borrower.

8.1.2. In the event of the Borrower committing breach of any of the Terms and Conditions.

8.1.3. In the event of any restriction imposed on the Borrower by an order of a competent Court or Order issued by any regulatory or statutory authority in India or any investigating agency.

8.1.4. In the event the pre-approved loan programme becomes illegal under the applicable laws, rules, guidelines or circular; or

8.1.5. In the event the pre-approved loan programme is terminated.

8.2. The terms and conditions concerning the consequences of termination of the Master Loan Agreement shall apply mutatis mutandis to the consequences of termination under the pre-approved loan programme.

9.1. For any queries, visit our website https://www.tvscredit.com/get-in-touch and follow the directions to get your query resolved.

9.2. InstaCard programme customers may also reach our Customer Care call center on 040-66-123456

10.1. Pre-approved loan programme shall be subject to the terms and conditions mentioned herein and any additional conditions stipulated by TVS Credit, from time to time.

10.2.The Borrower shall be responsible for reviewing these terms and conditions, including amendments thereto and shall be deemed to have accepted the amended terms and conditions by continuing to use the pre-approved loan programme facilities.

10.3. The Borrower hereby agrees to all the terms and conditions in the loan application form in the form and manner stipulated by the TVS Credit, from time to time.

Sign up for latest updates and offers